Founders Take Note - China Matters

Anti-China rhetoric is at an all-time high. A level not seen since prior to Nixon and Mao’s 1972 meeting. That meeting paved the foundation for rapprochement and, ultimately the better world we inhabit today. It was driven not by weakness or hate or anger on either statesman’s part but optimism for a better way (this article is published by my friend Geoffrey Handley)

Like leaders past, founders are driven by optimism, not so much asking the question “Why?” but instead, “Why not?”. Founders ask “How?” more than “What?”. As a breed, founders are unrelenting, unreasonable optimists but realists at every turn.

So it frustrates me, confuses me and concerns me when it seems that most hold or support either an outdated, incorrect or dare I say, ignorant view on China. Even more concerning is the widespread lack of opinion among founders who in their own words want to lead, change, improve the world.

40 days ago an event took place where China unveiled to the world what the future looks like. Once a year the curtain is pulled back on an event so large, so complex, so bladerunner-esque enabling thinkers, innovators, challengers and leaders worldwide a rare chance to observe and reflect, if not participate.

There was, sadly, little observation and even less reflection.

I am not a sycophant. I am an optimist and a realist. To those of you who want to change the world or are investing in those that do – how much larger does the sign post need to be to get noticed? China matters. China matters to you.

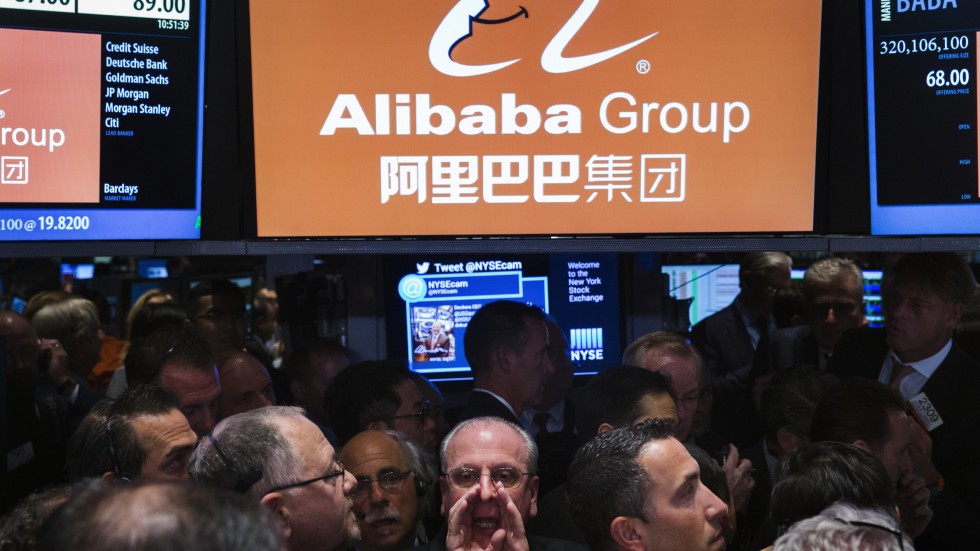

Singles Day 2016 clocked up $23.4 billion in online transactions. To give some context, the first hour alone saw more than the whole of Black Friday and Cyber Monday sales combined. A single day larger than Brazil’s 2016 ecommerce total.

If Single’s Day was a country in itself, it would be the 11th largest ecommerce market globally.

One day.

24 hours.

All online.

Over 80% on mobile – transactions that is, actual mobile payments and I’m not talking about credit or debit cards.

For years, this is the world that we have been painting to our teams, investors, the world, hell, to anyone that would listen. From the first time I heard Jeff Bezos and Mark Cuban to my own early startup days in the late 1990’s, to right now.

Content, media, network infrastructure, predictive analytics, logistics, payments, supply chain, biometrics, gaming, deep-learning, robotics, insurtech, autonomous vehicles, adtech, brand equity, CRM, engagement and loyalty all the way to the actual products themselves – it’s staring us in the face, here, today.

You could be forgiven for thinking that this is about Singles Day or Alibaba or even about the size of the Chinese market. Trust me, it isn’t.

It is, as the title suggests, about the fact that China matters and founders, and the investors behind them, can no longer carry on either ignoring or pretending that it doesn't or worse still, that you and your business are so special, so different, unique and will somehow be granted immunity.

You aren’t and won't.

It is, as the title suggests, about the fact that China matters and founders, and the investors behind them, can no longer carry on either ignoring or pretending that it doesn't or worse still, that you and your business are so special, so different, unique and will somehow be granted immunity. You aren’t and wont.

As founders, we back ourselves. We have unwavering commitment, passion and self-belief. Bordering, at least to outsiders, on insanity maybe, but not ignorance. As a breed we are generally hyper self-critical. Contrarian thought for most is about challenging the status quo – challenging what “others” think. For founders it’s also about challenging one’s own views. More than simply questioning what we hold to be true, the most impactful start with the assumption that it’s more than likely not.

It is this contrarian perspective that enables rapprochement and changes the world.

In recent years I have had the privilege and opportunity to learn from and support some incredible founders, their contrarian courage impacting billions. Everyday countless more seek to inspire and change the world. Which is why, with all the transformation, innovation and challenging of conventions, it's hard to understand how so few founders hold even an opinion, let alone have a strategy for their relationship with China Inc.

The underlying issue - most founders just don’t think China is important.

...founders need to come to the realization that they do, in fact, have a relationship with China - not least because it’s pretty clear that China has a relationship with you.

How wrong you are. Regardless of what problem you’re solving, audience you address or sector you're targeting, founders need to come to the realization that they do, in fact, have a relationship with China - not least because it’s pretty clear that China has a relationship with you.

No one can dictate what markets, geographic or otherwise, you chose to operate in, sell to, service, hire or source from, or be based in. That's your prerogative afforded by capitalism.

Likewise, choosing to ignore that this also true for everyone else is the fool's prerogative.

Regardless of industry or product, a common requirement for success is shared by all. In order to succeed, you’ve got to be intentional. At the most basic level, this is what strategy is – a comprehensive set of deliberate, aligned intentions with a map to navigate.

To founders claiming a worldview - China needs to fit into yours and your leadership teams’ vocabulary somewhere. The days of the binary China view of either maybe a potential market opportunity or simply a source of cheap supply are well and truly over.

Lyft, Uber or LinkedIn, Apple, Autonomous.ai and others have shown us – it doesn’t matter if you’re buying something here, making something there or selling something somewhere in between, if you’re raising money or investing or even if you are 100% firm that you have no plans go to China - China, opportunities, threats and all, is coming to you.

Your competitors.

And to your investors.

Or directly to your customers…

Local & Global Dominance -the rise of Chinese brands

China is the world’s largest smartphone consumer AND producer. Even excluding “foreign” or global brands (Apple, Samsung, etc.) that are produced or assembled in China, over 40% of all phones shipped globally in 2015 bore a Chinese marque.

Over 40%. Of all devices. Globally.

The point being not simply Chinese made but actually Chinese branded - a huge difference.

And it's not just a volume skew. It's actually about the brand.

Don't quite believe me? By Q4 2015, according to Kantar, Huawei took the #2 spot in Europe. That wasn't by accident or dumb luck. Call it what you will - growth hacking, market entry, war chest, international expansion, global footprint - it was by design, plain and simple.

And the trend continued, quickly becoming 1 out of every 2 devices. As this widens, very soon you could be making choices between brands you most likely don't recognize or have any affinity to...yet.

Rebuts range from "those brands don't matter” or “they only make cheap shit" or "they're only for Chinese consumers" to the perennially unfunny "how do you even pronounce it?" Think again.

Let’s start somewhere simple, one of my anchor principles (and a hypothesis I have yet to disprove) is that there will always be a better solution, a smarter answer, a more insightful perspective. Success comes from doing better things, better. Every day I meet companies quick to tell me they are doing something better than their competition or better for their consumers – my question is always the same; “Have you looked at what they are doing in China?”

Looking to China should be no different than looking at your customers and competitors in your SWOT 101.

Try this - think of China as one giant start up. That unconstrained nimble “no rules” thinking that startups are known for – that’s what the 1.4 billion people in China do every day, just to survive. In the PC / mobile shift we called it leapfrogging. In my Hyperfactory years, we set up the China office in 2006 not because there was huge smartphone penetration, there wasn’t, but because it was clear to us that a) mobile was the future and b) China was going to leapfrog the PC and fixed line internet.

Basically, China (not necessarily doing business in China) was going to be our window to the future.

Consumers and businesses in China have leapfrogged both traditional and digital channels and are engaging businesses and each other through real-world and digital platforms in ways that go far beyond those in the developed markets.

You don’t really think that Singles Day would be possible without new platforms, processes and behaviours, do you?

China used to be a cash society.

Just five years ago, 80% of ecommerce was paid for by cash on delivery. Cash now accounts for less than 15% - BUT with credit card ownership as low as 8%, how are they paying???

In 2015 mobile payments in China reached $1.4 trillion. Trillion. Over 60% of Chinese shoppers use their mobiles to pay for things everyday. In the US it’s less than 2%. But trust me, that will change.

Want to get your head around the future of how we will buy and pay for things? Then look towards China because we are living your future right now over here.

If even China’s wet markets and roadside dumpling sellers are accepting mobile payments, wouldn’t it be smart to get a handle on the future now, or at least a glimpse?

Follow the Money

Even on a macro level the growth in China’s appetite for US investment has been staggering. (*Up until last week) China is the largest foreign holder of US Treasuries, with over $1.24 trillion (a 20x increase since 2000) and the 3rd largest consumer of US exports. Direct investment in the US has reached an all-time high including the 100+ M&A deals across all sectors from hospitality to Hollywood – but as Thilo Hanemann and Daniel Rosen point out the clear shift is towards tech and services. More importantly, investors are now largely private, with State driven investments now less than 20% of total deals.

It’s not only traditional scale deals like Haier’s $5.4 billion acquisition of GE’s appliance unit – Prior to the Didi / UberChina deal, roughly 20% of all money raised by Uber had been raised from Chinese investors.

Whether it’s Alibaba’s 2015 investment in Snapchat, Didi’s $100 million in Lyft or AngelList’s $400 million CSC Upshot seed fund – private Chinese investor appetite for tech and related services is growing. I see this myself first hand, with requests from local investors increasing weekly for dealflow outside of China.

Just a few weeks ago saw Redpoint announce a China fund, followed by WeWork raising a $260M Series FII round from state-owned hotel / travel / activity giant Jinjiang International Group. And while recent data from @CB Insights show that fully one quarter of US Unicorns have a Chinese investor, funding is at ALL levels.

While I hear founders lamenting the fund raising process all the time, I hardly ever hear founders laying out their strategy targeting Chinese investors.

It flows both ways – at least the smart money does, into China and Chinese startups – from headliners like Apple’s recent $45 million research hub or Amazon’s $75 million acquisition of local ecommerce play Joyo back in 2004. Joyo now revenues now of over $3 billion, and as @Peter Fuhrman of China First Capital points out, “Amazon is the only non-Chinese company with meaningful market share and revenues” (in China’s ecommerce sector).

I recently listened to pitches from the latest batch, Batch 10, of startups from Chinaccelerator, the most successful incubator in China. William and team has been cultivating smart, successful startups since 2010 – there’s no shortage of opportunities for smart money investors.

“If we just get 1% of the market, it will be huge!”

I’m not going to tell you how you need to be here because a billion plus people desperately want to buy your products and services – what I am going to tell you is that they are ALREADY buying and using yours or your competitor’s products and services and you probably don’t even know. Worse still, if you do know, very few of you are doing anything deliberate about it.

Haitao 海淘 – which translates as ‘searching abroad’ – describes the phenomenon of Chinese consumers buying international products via overseas online shopping platforms. Haitao has evolved to become a powerful phenomenon in China – Nielsen estimates that Chinese spent 216 billion yuan via Haitao in 2013 – predicted to reach 1 trillion yuan in 2018.

Proof being the 30% of purchases on Singles Day from international brands or international merchants. Just this alone was more than Cyber Monday and Black Friday combined.

Last night I watched an interview with China’s Minister for ecommerce – Yep, Minister for ecommerce – Outlining how this will be one of the most dynamic growth areas in China's already massive ecommerce landscape.

Not only are Chinese in China using your services and buying your products OUTSIDE OF CHINA, on your own home soil, so to speak, the Government is encouraging this and making it easier for the population to give you their money – a far cry from recent claims of Chinese “raiding the US piggy bank” nonsense.

Hangzhou, host city of the recent G20 meeting and home to Alibaba, has been established by the government as a key infrastructure point for this cross-border e-commerce strategy from logistics, customs clearance, tax refunds, payments and exchange settlements. Consumers are now able to obtain foreign products through the zones' bonded warehouses in one to three days.

Show me another country that has not only worked through the end-to-end global ecommerce supply chain, but has also built the accompanying complete industrial and infrastructure support chain to facilitate this global trade-friendly view.

Show me another country that has not only worked through the end-to-end global ecommerce supply chain, but has also built the accompanying complete industrial and infrastructure support chain to facilitate this global trade-friendly view. It's a world away from the neo-colonial, punitive, win/lose bully tactics reminiscent of the 19th century era “international free trade”- but that’s a discussion for another day, along with seriously racist cover art!

Still not convinced?

If, after all of this you still think that it’s not in your’s or your shareholders interests to address, or at the very least construct a comprehensive, informed opinion on China, consider the 120 million Chinese that traveled overseas last year - half of whom are aged between 15 and 29, and 37% between 30 - 44.

They’re university educated, feel more in common with their age group globally than previous Chinese generations, view the USA positively (well, did when the research was conducted!) and over 60% would choose western luxury brands over Asian.

In case you’re wondering where they are going - travel to the States and Europe increased 191% and 97% in 2015. The Asia-Pacific, Africa, and the Middle East are also favourite destinations, but with this sheer volume, what’s important to remember is that regardless of where Chinese choose to go, it will be in numbers and they will spend. Be it on luxury goods from Gucci or Louis Vuitton, or baby milk powder from Mead Johnson or diapers from The Honest Company, or tickets and merchandise from a Manchester United match or an NBA game.

Think about this…Just like you and yours, Chinese search for directions, read reviews, watch shows, buy tickets, order food, book rides, want bargains, etc. If you’re the market leader in your home market, when 20+ million customers land in JFK or London Heathrow or DFW do you want to just leave it to chance that they might know of you, or come across you when they, what…flip open a complimentary hotel copy of the local yellow pages? (if they still even print them?)

Or maybe they’ll hear about you from their Lyft or Uber driver, after all, they’re familiar with them.

With their average income set to double in the next decade, Chinese Millennials will not only travel more, consume more of the world’s brands in almost every category, they will also want to invest in and start more and more global game-changers.

So, founders, please take note, China matters to you, but if you think it doesn't, and with the greatest respect, please let me know.

With that, I hope 2016 has been good to you and that 2017 will be even better. Now more than ever, we will need our brand of unrelenting optimism for a better way.